by Patten Mills | 3 min. read

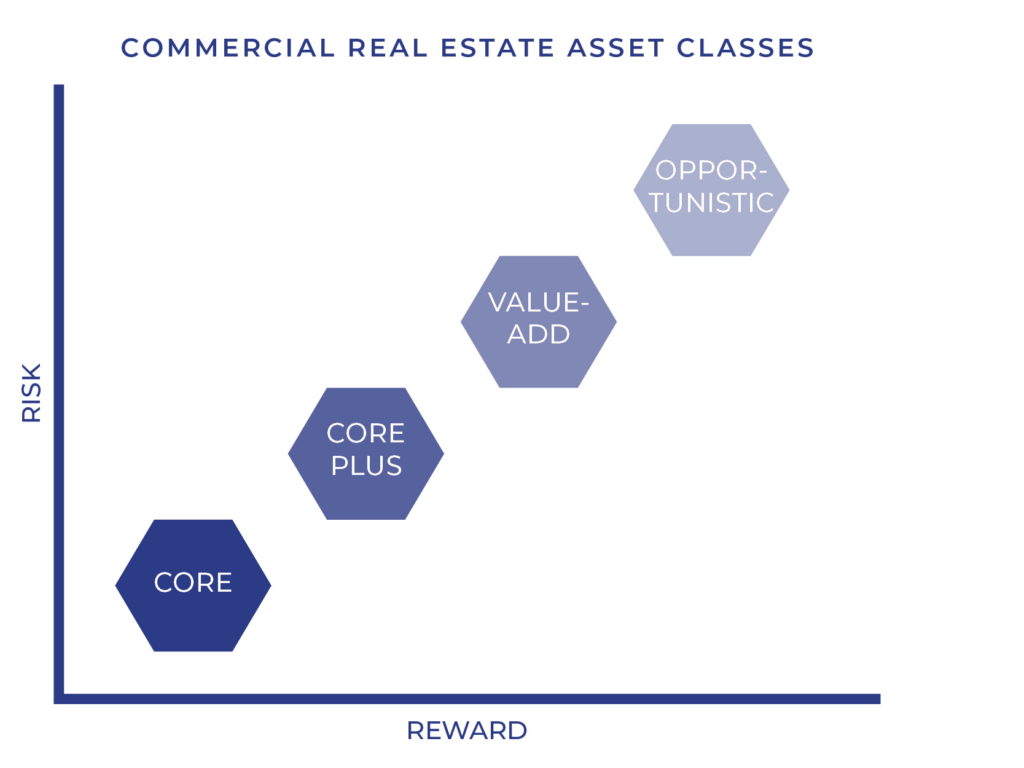

All real estate investment strategies share a common goal of achieving a return above interest and inflation. The timing and the potential of their return depends on the type of investment property and strategy used. Categorizing commercial real estate into a spectrum of four general types of investments provides investors with perspective in evaluating which opportunities to pursue. Value-add and opportunistic properties represent the moderate to high-risk end of the continuum of commercial investments. Depending on the experience, skillset, and resources of the investor, these properties may be worth the risk for the chance of greater financial gain in comparison to their core and core plus counterparts.

VALUE-ADD PROPERTIES: Properties with Potential

Investors must determine the potential return that makes a project worthwhile. The higher risk associated with value-add properties relative to core plus equates to greater upside potential. Value-add investors can realize significant returns from appreciation as well as cash flow but must invest additional time and capital to achieve it. While core and core plus properties both, typically, have low vacancy and immediate cash flow upon acquisition, value-add properties have limited or reduced cash flow before the value has been added and, therefore, much less predictable returns. The property may have anything from below market rents, low occupancy, significant deferred maintenance, or require major renovations. An investor must have the skillset, resources, and experience to either decrease expenses or increase income.

For example, construction companies interested in owning or flipping commercial real estate are an example of an investor who may be well equipped to take on a value-add property in need of major repairs. They would have the knowledge, resources, and expertise to renovate the property as well as estimate the cost and timeline of the project. If a construction company can purchase and renovate a property in the right location, they may have the potential to attract stronger tenants and reposition it to a core or core plus asset. This would allow the property to obtain higher rents and sell at a much lower cap rate. Similarly, an engineering company may recognize the potential developability of a piece of land and find it financially worthwhile to purchase it and then sell to a developer with entitlements in place. In both scenarios, the investors have the right skillsets to add value.