by Katie Spurrier | 4 min. read

by Katie Spurrier | 4 min. read

Love it or hate it, technology is an undeniable reality of our day-to-day lives. Technological advancements have forever changed the way we live and work, reshaping entire industries including commercial real estate (CRE). Proptech (property + technology) is the wide range of systems that use technology to streamline the ways we interact with all aspects of the property transaction cycle from researching and listing to buying and selling. Proptech includes data analytics, artificial intelligence (AI), the Internet of Things (IoT) and other innovative tools to make businesses more efficient. Born out of the late 1990s “dot-com boom” in the San Francisco Bay Area, proptech continued to grow in the 2000s.

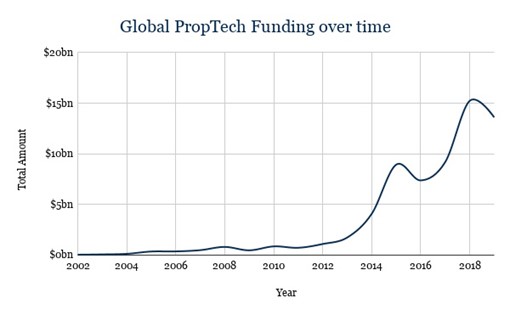

Figure 1 shows global proptech funding over time and its dramatic increase in roughly two decades. Fundraising in 2021 hit a record high as the industry relied on technology to recover from the COVID-19 pandemic.1 In fact, the United States’ proptech market was valued at $18.2B in 2022 and is projected to reach $86.5B by 2032.2 It’s important to understand proptech trends and their potential impact as technology will continue to influence CRE in the future.

Figure 1: Data sourced from: https://www.unissu.com/proptech-resources/deep-dive-analysis-of-PropTech-2020-the-future-of-real-estate

Consider the following practical application of proptech. Currently, United States’ office vacancy is nearing a record-breaking 20%.4 Imagine you’re a tenant leasing space in a commercial office building. Over time, you’ve noticed fluctuating occupancy rates within your space. Using IoT technology, an occupancy monitoring system can be installed with infrared, thermal, camera, radar, or Bluetooth sensors to calculate the number of people present in each room in real-time. The data shows some offices and conference rooms are underutilized while others are overcrowded. The sensors also identify peak times so meetings and office hours can be scheduled accordingly. Insights from the data allow you to make informed decisions about the build-out and how the space is utilized. Maybe your business needs fewer conference rooms than you initially thought, and some areas can be repurposed. Perhaps your workers have a hybrid working arrangement and are more present certain times of the year. When your lease is up for renewal, you can examine usage patterns to determine if less square footage is needed, potentially reducing your rent. If the company continues to grow, you can also rely on the data to plan expansions or relocations and other desired amenities.

You’re probably thinking, how does proptech benefit me as a property owner, tenant, or investor? Proptech platforms provide buyers with easily accessible and current information about properties. According to one forecast, 44% of buyers locate their properties online before working with a real estate professional.5 The market data allows consumers to make informed decisions and pursue fair transactions. Streamlined searches save time and effort. Most people also prefer digital communication methods and text or email to ask questions about a property and book showings. Virtual reality and 3D tours allow buyers in other cities or countries to view local properties. Buyers can even review and sign contracts digitally. Proptech can provide flexible financing options for investors, and energy-efficient technologies can lower costs for property owners. Proptech makes it easier to diversify your portfolio by having access to global, real-time information. Most importantly, proptech can reduce transaction costs and lower operational expenses.

According to one author, “Proptech will never eliminate or invalidate the deep industry knowledge required to thrive in the real estate industry. But by purposefully connecting the right dots, commercial real estate technology makes information more accessible and empowers professionals to systematically make data-driven decisions in a faster, more efficient way, driving revenue as a result.” 6

ROCK’s extensive industry knowledge and data-driven research ensures you receive the best possible service for your real estate transaction. View our market reports to learn more.

SOURCES

1 McClure, Olivia. (2023, August 21). Proptech: Everything You Need to Know (With 28 Examples).

Retrieved from https://builtin.com/consumer-tech/proptech

2 Jaffer, Zain. (2022, November 29). Four Leading Trends in The Proptech Industry. Retrieved from

https://www.forbes.com/sites/forbesbusinesscouncil/2022/11/29/four-leading-trends-in-the-proptech-industry/?sh=3403e4dc122a

3 Tamn, Jon. Proptech: What It Is & Why It Matters in Real Estate. Retrieved from

https://butterflymx.com/blog/property-technology/

4 Theiss, Eliza. (2023, August 22). National Office Report. Retrieved from

https://www.commercialedge.com/blog/national-office-report/

5 National Association of Realtors. (2022, December 29). What is Proptech? Retrieved from

https://www.nar.realtor/global-perspectives/what-is-proptech#:~:text=Proptech%20is%20short%20for%20%E2%80%9Cproperty,listing%20to%20buying%20and%20selling.

6 Carrigan, Matt. (2023, February 8). What is Proptech? Understanding Commercial Real Estate

Technology. Retrieved from https://www.dealpath.com/blog/what-is-proptech-commercial-real-estate-technology/